...

More ?

Investment markets are eagerly anticipating the potential for more balance sheet-expanding monetary stimulus. Not only would another round of quantitative easing (QE3) from the U.S. Federal Reserve likely send the stock market (SPY) into another euphoric high, it also has important political implications. The conventional wisdom has long been that any further QE would provide a boost to President Obama in his re-election efforts. A closer look at the data reveals, however, that another round of QE could precisely be what causes him to lose the office in the end. Why? Because oil and gasoline prices would likely soar. And while commodities traders may rejoice, most Americans are likely to feel otherwise each time they visit the gas pump.

Despite his persistent lead in recent polling data and the benefit of being the incumbent, President Obama still has some historical obstacles to overcome. Most notably, over the past three-quarters of a century, since Gallup began polling presidential job approval, no past U.S. President has won reelection with a rating below 50% on election day. So with President Obama currently hovering at a 45% job approval rating, his campaign has a vested interest in trying to lift this number above the key 50% level, starting this upcoming week at the Democratic National Convention.

Some cynics are watching the Fed closely, for the timing of any QE3 program in the coming weeks may be viewed by some as an effort to give the President a boost leading up to the election. This is due to the fact that QE has had a notably profound impact on the stock market, causing it to rise virtually without interruption once the program is put into place. And given the fact that many in the media and some in the public still perceive that the stock market is a reliable measure of the economy, any such rally would presumably provide fresh hope in the current administration among those voters that are otherwise concerned about their future prospects that things are on the mend.

But when taking a closer look, the Fed launching QE3 has the potential to more profoundly hurt President Obama in his re-election efforts than help him. This is true for the following reason.

The stock market is not the only investment market segment that gets euphoric under quantitative easing. The commodities market has also shown the propensity to rise sharply behind QE monetary stimulus. This, of course, includes the oil and gasoline markets. And while only 54% of Americans own stocks and 46% do not, according to Gallup, nearly 100% of all Americans have to stop into a gas station at least once or twice a week to fill up their car or travel on some other mode of transportation. Nearly 100% of all Americans also need to heat their homes in the winter time and cool their homes in the summer. So if the Fed opted to launch QE3, oil and gasoline prices are also likely to spike sharply higher.

(click to enlarge)

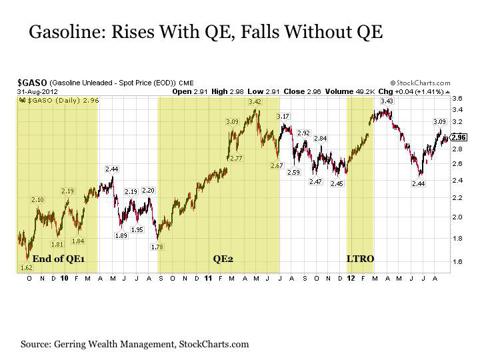

Focusing on the price of gasoline at the pump, a look at past stimulus programs highlights this point. During QE1 from March 2009 to March 2010, gasoline prices spiked +86% higher. And from the announcement of QE2 in August 2010 to its end in June 2011, gas prices posted a double at +101% before cooling off and ending +75% higher. Moreover, it is not just balance sheet expanding monetary stimulus from the Fed that causes gasoline prices to spike, as policy actions from the European Central Bank (ECB) have shown to have a comparable impact. During the ECB's long-term refinancing operation (LTRO) from December 2011 to February 2012, gasoline prices jumped +25% in just over two months.

What about when the Fed and the ECB are not applying balance sheet expanding monetary stimulus? Gasoline prices quickly drop, falling by -23% between QE1 and QE2, by -17% post QE2 until the launch of the ECB's LTRO program and -28% post LTRO through this summer when talks of more balance sheet expanding monetary stimulus began to heat up.

So in short, when the Fed is applying QE, energy prices, including oil and gasoline, soar higher. And when the Fed steps away from QE, energy prices, including oil and gasoline, quickly fall back.

And it is the impact particularly on gasoline where QE would have the most direct negative impact on President Obama and his re-election prospects.

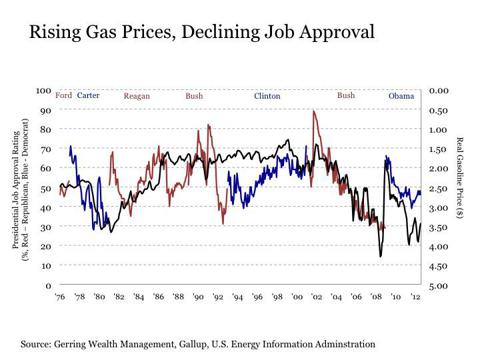

Historically, a strong negative correlation exists between gasoline prices and Presidential job approval ratings. While other contributing factors are also likely along the way, rising gasoline prices help explain to a meaningful extent when a President experiences a steadily sharp decline in job approval.

(click to enlarge)

Therefore, while conventional wisdom may suggest that QE3 might boost President Obama's re-election chances, in reality, it may serve as an undermining blow to his prospects due to the likely impact on gasoline prices and subsequently his job approval rating. As a result, more balance sheet expanding monetary stimulus may be the last thing that the President wishes to see from the U.S. Federal Reserve or the ECB. So for those active in the Intrade markets, a worthwhile strategy to consider might be to fade any initial QE3 pop in President Obama's re-election odds.

But the better question to consider from an investing standpoint is how to potentially capitalize on rising oil and gasoline prices from any balance sheet expanding monetary stimulus program from either the Fed or the ECB in the coming weeks.

One option to consider would be the various exchange-traded products that are designed to track the prices of oil and gas. Leading among these are United States Oil Fund (USO), the PowerShares DB Oil Fund (DBO) and the iPath S&P GSCI Total Return (OIL). But while the use of such products has its merits depending on the specific circumstances, they are also riddled with complications that must be carefully considered, including prospectus language, counterparty risk, tracking error relative to the underlying commodity price resulting from the rolling of futures contracts, and expenses. In addition, both the USO and the DBO come with the K-1 tax form, which can make tax filing more cumbersome for many. As a result, it is worthwhile to explore whether other alternatives are available that may provide reasonable exposure to oil and gas.

One such alternative is the stocks of oil and gas companies. But this also comes with its own set of risks, including both operational risk and financial risk, as well as exactly how well the price performance of each individual company actually tracks oil prices. But one particular name in the energy sector does stand out as an ideal choice to accomplish this task.

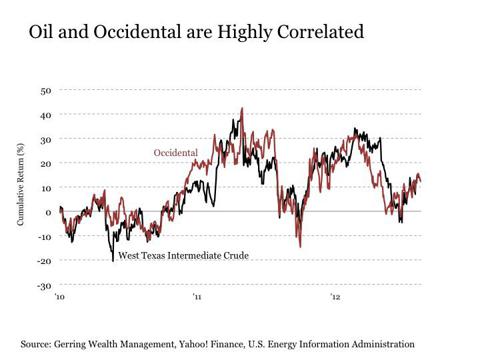

(click to enlarge)

Occidental Petroleum (OXY) has demonstrated itself to closely track spot oil prices in recent years. As a result, it represents an attractive alternative to capture a rise in oil and gas prices under any balance sheet expanding monetary stimulus scenario. Adding to its appeal in this regard is the fact that Occidental is also among the most financially healthy and best managed firms in the broader market that has a strong track record of growth and free cash flow generation. It also has an attractive business mix in the energy space through its exposures to both oil and natural gas.

So while the conventional wisdom may still be that another round of monetary stimulus may help President Obama's re-election chances, it may actually hurt them due to the likely spike higher in oil and gas prices. But for those investors seeking to capitalize, investing in an oil and gas name like Occidental Petroleum may be among the best ways to capitalize on the situation.

Disclosure: I am long OXY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

...

More ?

ncaa oakland news alec baldwin alec baldwin college basketball oakland pinnacle airlines

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.